|

|

#1 |

|

Участник

|

stoneridgesoftware: Fixed Asset Depreciation Options in Dynamics NAV

Источник: https://stoneridgesoftware.com/fixed...-dynamics-nav/

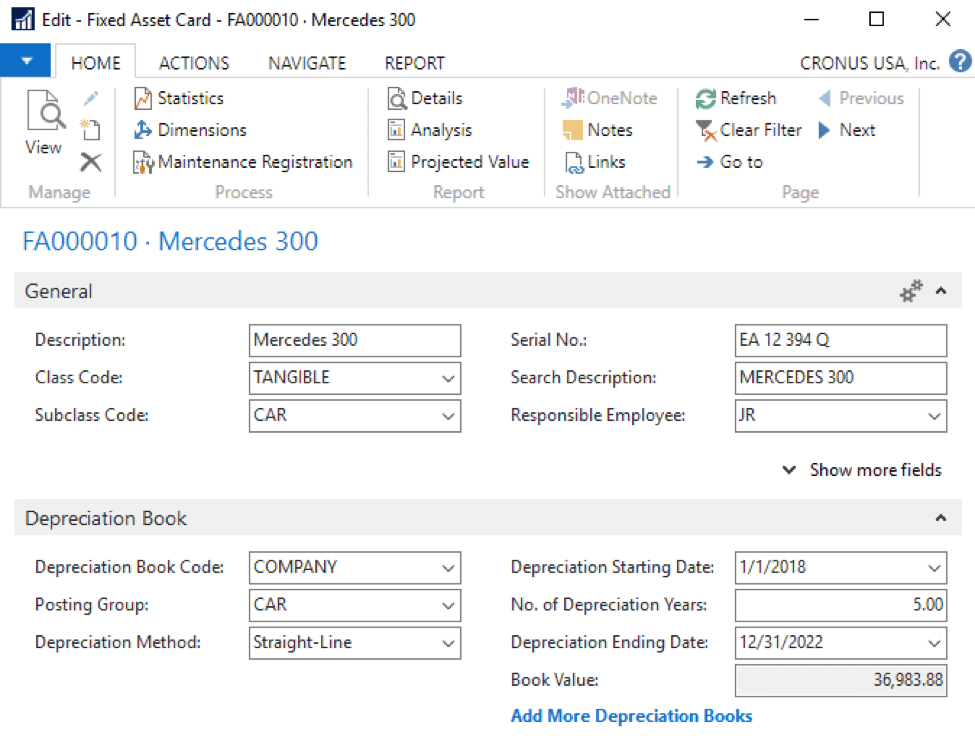

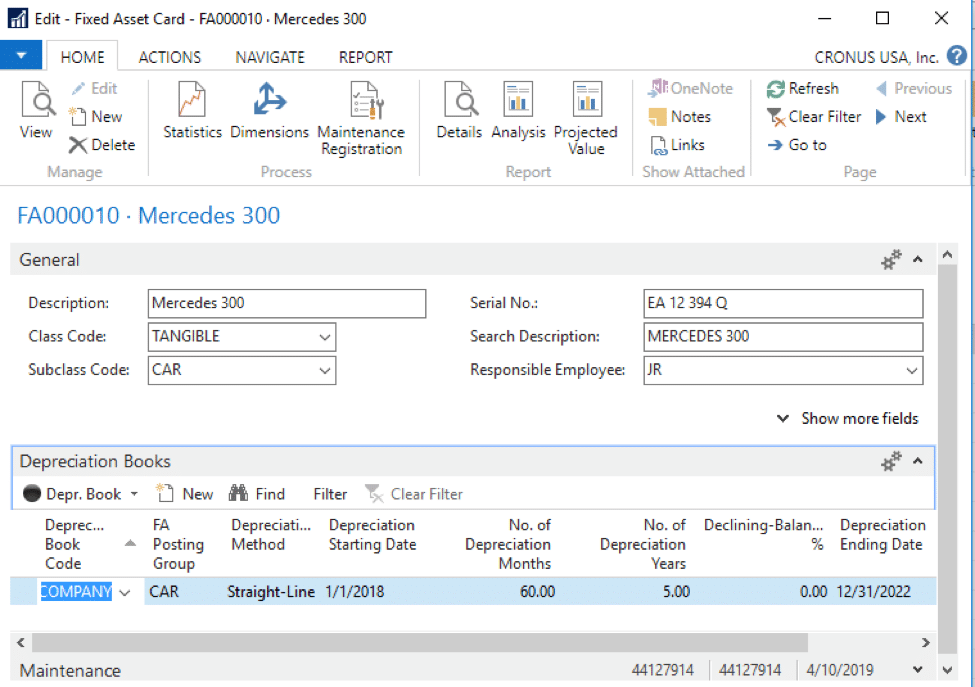

============== Fixed Assets in Dynamics NAV include a number of potential workflows, various possible settings to dictate general ledger integration, many asset categorization options, and additional features such as insurance and maintenance. The focus of this discussion will be on the depreciation engine itself and, specifically, the general options used to set up those depreciation calculations. To simplify the discussion, we will break up depreciation options into three categories: straight-line, accelerated, and manual. Straight Line Depreciation in Dynamics NAV For an asset that is to be depreciated equally over its useful life, the straight-line approach is most appropriate. On a fixed asset card, in the Depreciation Book FastTab, the “Depreciation Method” would be set to ‘Straight-Line’ and the “No. of Depreciation Months” or “No. of Depreciation Years” would be filled in. Entry of either time-period will calculate the “Depreciation Ending Date” for you. You may alternatively enter a “Depreciation Ending Date” that will drive the “No. of Depreciation Months” and “No. of Depreciation Years” fields. The three fields are interrelated and work in any direction.  If you are unable to see some of the fields described, select the “Add More Depreciation Books” option shown in the image above (in blue).  Accelerated Depreciation in Dynamics NAV For an asset that is to be depreciated in an accelerated manner (i.e. more depreciation earlier in the asset’s life), the declining balance options in Dynamics NAV are used. In general, declining balance calculations mean that the remaining asset life going into a fiscal year is used as a basis for the next year’s calculation. The asset’s depreciation percentage is then applied to the remaining asset value. As an example, a $6,000 asset with a 5-year life and a double-declining balance rule would be entered with 40% in the “Declining-Balance %” field (100/”life in years” x 2). It would then depreciate $2400 in the first year [$6000 x 40%], $1440 in the second year [($6000-$2400) x 40%], $864 in the third year [($6000-$2400-$1440) x 40%], and so on. The above example will generally hold in NAV, but there are two additional nuances you will want to consider. First, there are two declining balance approaches and, second, each of these can be offset with straight-line calculations. The result is a total of four accelerated depreciation options in the “Depreciation Method” field:

For an asset that does not conform to pre-configured calculation rules, there are two additional “Depreciation Method” options in NAV: User-Defined and Manual. For a ‘User-Defined’ method, a “Depreciation Table” must be manually completed and assigned to the asset. This is useful when you know the depreciation percentages to be applied each month or year and when those percentages are not readily definable using the methods described above. It also makes the most sense when the per-period percentages are known in advance of starting depreciation against the asset or when the asset will be depleted in units per period that can be later applied in the depreciation table. The ‘Manual’ method in NAV is simply a way to tell the depreciation calculation engine that you will be manually entering the depreciation each month in the FA Journal or the FA G/L journal. Final thoughts on depreciation calculation options The above should provide a general understanding of the depreciation calculation options. In addition, NAV offers numerous fields to influence specifics of the calculations. These include fields on the asset’s depreciation book for “Use Half-Year Convention”, “Final Rounding Amount”, “Use DB% First Fiscal Year” and much more. The following link on Depreciating or Amortizing Assets in Dynamics NAV from Microsoft’s Developer Network site will provide a jumping-off point to find additional information on those options as well as other fixed asset setup and related concepts. Although there may be some manual configurations and settings needed for some asset rules, there should not be any GAAP or MACRS concept not achievable in NAV. When in doubt, use your test environment and experiment with the various fields and settings to ensure you will get the calculation results you are targeting. Источник: https://stoneridgesoftware.com/fixed...-dynamics-nav/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|