Источник:

https://dynamicsax-fico.com/2017/10/...accounting-12/

==============

In this post, we will take a look at a more advanced allocation scenario where fixed and variable parts of selected cost elements are allocated from indirect to direct cost centers based on separate allocation bases. The next graphic illustrates the allocation approach applied in this post.

Step 1: Setup dimension hierarchy

Step 1: Setup dimension hierarchy

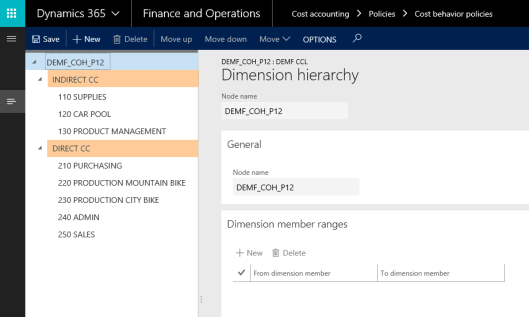

To get this allocation approach incorporated into D365, the previously used dimension hierarchy that differentiates between direct and indirect cost centers is used once again.

Step 2: Setup cost behavior policy

Step 2: Setup cost behavior policy

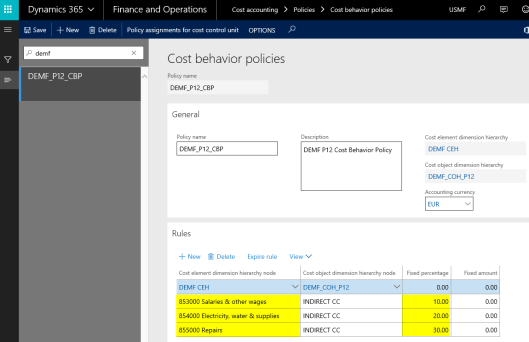

The next setup required concerns the cost center behavior policy of the different cost elements. The following screenprint documents how this setup has been made.

Please note the different fixed percentage rates for the cost elements 853000, 854000 and 855000 from the screenshot shown above. To ensure that no other fixed costs are setup and caught by the allocation policy, an additional cost element dimension hierarchy node (‘DEMF CEH’) – with a fixed percentage rate of 0.00% – has been included in the cost behavior policy rule section.

Step 3: Setup hierarchy allocation bases

The third setup step relates to the hierarchy allocation bases that will be used for allocating the fixed and variable costs.

The first hierarchy allocation base (‚DEMF_P12_FIX’) that will be used for the allocation of the fixed costs from the indirect cost centers to the direct cost centers refers to the numbers of bikes produced.

Please note that the allocation base (‘3. BIKE PROD STAT DATA’) is a statistical member that has already been used in prior posts.

The second hierarchy allocation base (‘DEMF_P12_VAR) also allocates costs to the direct cost centers. However, different from the fixed cost part, the employment related statistical measure (‘1. EMPL STAT DATA’) is used as allocation base for the variable costs.

Step 4: Setup cost allocation policies

The cost allocation policy shown next, combines the different ‘pieces’ that have been setup and explained before. Because the setup of cost allocation policies have already been explained in previous posts, no further explanations are made here and reference is made to the previous posts on the new cost accounting module.

Step 5: Setup cost accounting ledger & process data

Step 5: Setup cost accounting ledger & process data

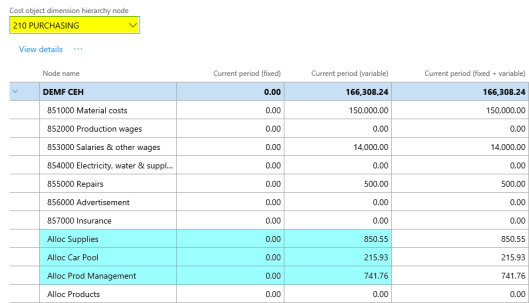

After the cost accounting ledger is created and the costs and policies processed – not shown for reasons of brevity – the following costs can be observed from the cost controlling workspace for the different cost centers used.

Please note especially the fixed and variable cost columns for the different direct and indirect cost centers.

For a better overview of the fixed and variable cost allocations made, the following graphic has been developed, which summarizes the different costs and allocations for the cost centers used.

In the next post, we will take a look at cost distribution policies and how they differ from cost allocation policies. Till then.

Filed under:

Cost accounting Tagged:

Controlling,

Cost accounting module,

Cost center accounting,

fix-variable,

Hierarchy allocation base,

Hierarchy based allocations,

Management Accounting

Источник:

https://dynamicsax-fico.com/2017/10/...accounting-12/